Blockchain technology: what it is and how it is going to transform our lives

15 of December of 2017

For some, Blockchain is a revolution that will change our lives. For others, it is a technology that will go out of style and will not be able to meet expectations. What is certain is that it is a hot topic in the digital world. There are hundreds of forums and discussions to talk about what it is, what it will be and its applications. We will try to look at a global vision of technology, without going into too many technical details, and we will review its history and characteristics.

But before starting at the beginning we will go to the end for a moment.

What problem does Blockchain solve?

Let’s take a look at an example:

Your supply company bills you X amount of money every month in your bank account. You do not actually give cash to the representative of that company. It’s just that the bank specifies in their records that X amount of money has been transferred to your account and updates the balance sheets. That record must be truthful and reliable, but neither you nor the company that bills you controls this. A third party is needed, in this case a bank, which has your trust but which we can see is a clear weak point. What happens if the bank stops being honest? What happens if the bank does not do its part and misses the new transactions or changes the old ones? The problem is that the responsibility of your agreement falls on a point that can be compromised, deleted or corrupted. Obviously the trusted third parties have preventive and corrective measures so that there are no errors in the process as a matter of reputation but they cannot guarantee that everything will always be correct.

This is the main problem that Blockchain solves. It confers confidence on agreements/exchanges between two parties, without intermediaries. How do you get it?

Genesis

Now let’s go back to the beginning. Back in 2008, someone named Satoshi Nakamoto (nobody knows what group or individual is behind this name) presented his decentralized digital currency project to the world. He did not hold a press conference or call all the TV stations, he presented it on a mailing list about cryptography with this message that included the paper explaining the details of the cryptocurrency:

An interesting conversation started as a result of that message and although most people who participated in it were very sceptical and spent their energy pointing out the alleged failures of the system, a developer named Hal Finney was fascinated by the project and helped Satoshi deploy the first Blockchain network, which Bitcoin sits on. It was January 2009 and a new technology was born.

What is a Blockchain?

A Blockchain is basically a database similar to a digital accounting ledger book that stores all the transactions made between users in its pages. This ledger book is made up of blocks and each block would be equivalent to a page in the actual ledger containing a variable number of transactions. Therefore, by adding blocks, we create a record of all transactions. So far we haven’t mentioned anything especially novel but there are indeed two characteristics that give tremendous value to this database: Immutability and data distribution.

Immutability

How is the immutability of the data guaranteed? In a strict sense, it is currently impossible to guarantee the immutability of any data. All digitally stored data are susceptible to being compromised, but what can be done is to make them extremely difficult to alter; that using the power of computation available today it is possible to make it take centuries to alter data that has already been validated and saved. And that’s how Blockchain does it.

To be included in the main blockchain, it is essential that the new block be “sealed”. This seal is created by applying a cryptographic algorithm to certain information that basically contains:

- The seal of the immediately preceding block.

- Information about the transactions in this block and the block itself.

- A random number that has to meet some conditions, but we’ll come back to this number later.

The important thing here is that the information obtained in the previous block is used and thus all the blocks are linked together in chronological order. Thereby having a chain of blocks.

The cryptographic algorithm creates a unique seal that would be totally different if only one of the block’s bytes changed, so if something is changed in a block after being inserted in the chain, its seal would change and therefore, since that seal made up part of the next seal, all subsequent blocks would have to change their seal as well. This makes checking the validity of the data simple and on the other hand, modifying a transaction is very expensive since you have to change your block, plus all subsequent blocks. And the older the transaction, the more expensive it is to change it. Also, since all users have a copy of all the blocks, when they receive the copy with the seals changed, they will reject it because it does not resemble yours, so you will have to find a way to change not only your chain of blocks but also that of the majority of network users. This is how the validity of the data is guaranteed. But who seals the transactions? Miners.

Data distribution and mining

There were already many attempts to create a digital currency, such as Digicash, E-gold or Flooz. However, they all had a problem that Bitcoin solved: Double-spending. These currencies had vulnerabilities that would allow them to use the same money to pay for two different things. Although it is not strictly impossible to execute a double spend in Bitcoin, the likelihood is quite minimal and if it were to occur it would be detectable and correctable.

Avoiding double spending is achieved through the distribution of data and mining. Each time a transaction is made between two accounts, it is reported to the entire network. They all validate and enter that transaction in their local copy of the account ledger. When the time comes to seal the block, the network nodes that are engaged in mining (which anyone can do) compete to be the first to find the random number that must be included in the seal.

Let’s remember the random number that went on the seal. The miners are given conditions that this number must meet and they are sent to search for it until it is found. It’s like a riddle that must be solved even though it does not involve logic or inquiry. It can only be found by testing numbers one by one in the cryptographic algorithm until the correct one appears. Pure chance. The first one that gets it seals the block and informs the entire network of the complete block – with the seal included. Everyone then checks that it is correct and they enter it in their ledger book, initiating a new block that will be linked to it.

This search for the number in which the miners spend resources (electricity basically) is called proof of work and is the great innovation introduced by Satoshi Nakamoto and that avoids the problem of double spending that the other currencies had. And why do the miners expend resources in mining if they could wait for the block to arrive without complicating their lives? Because they are rewarded by doing so. Because each sealed block grants a reward in Bitcoin (the price has already surpassed $15,000) and also the transactions can carry a fee and all that money is given to the miner that seals the block. Combining decentralized networks, cryptography and incentivisation, Satoshi provided a practical solution to the problem of Byzantine generals , a great advance in the confidence and consistency of distributed data that makes Blockchain technology very powerful.

Blockchain 2.0

In 2015, a new horizon opened with the arrival of Ethereum. Until then, the Blockchain had been used mostly to create digital currencies. These networks were very limited in terms of creating scripts so they could not be used for much more than to exchange assets between accounts.

But Ethereum is not strictly a digital currency. It is also a platform, a Blockchain network in which projects can be deployed that use their own tokens or cryptocurrencies. These tokens can represent any real-life asset, not just money, and endow the assets they represent with unprecedented flexibility in their trading, tracking or manipulation. The tokens are also used by many of the projects as a funding channel, distributing them among the users in exchange for an economic contribution and acting in a manner very similar to the actions of a company.

The platform also offers the possibility of running so-called smart contracts. These are scripts that are stored in the Ethereum Blockchain and perform actions automatically, turning the platform into what is called a complete Turing environment, unlimited theoretical capacity to solve any computational problem. This is not new in the computer world but it is something that the previous Blockchain networks did not have and that opens a huge range of opportunities.

An example of a smart contract would be: A musician publishes an album and creates a smart contract with the distributor in which it is agreed that for each album sold he receives 5% of the money obtained. The contract itself will connect once a week to the list of discs sold and with the figure will proceed to transfer the money from the distributor’s account to the artist’s account. Once deployed in the network and validated by both parties, it will no longer be necessary to worry about the issue anymore as it remains forever in the Blockchain without anyone being able to change it unless they have both parties’ consent. This can extend to thousands of cases in which you do not even need to know the other party or live near it because the network provides the confidence that what you agree on will be fulfilled.

Present, future and real applications

As we all know, almost anything can be written on paper but what seems wonderful in theory gets muddied when you actually try to carry it out in a real situation. It seems that it is harder than expected to apply in practice what is described in the papers presented by Blockchain world entrepreneurs. Right now there are more than 1,200 cryptocurrencies trading on the market. It is assumed that most of them are backed by a real-world applicable project but few actually have anything to show except a timeline and some very good ideas. It is true that most “roadmaps” for these projects are under development or at a very early stage because the cryptocurrency boom came about at the beginning of this year but we will see how many are actually viable and provide value and how many will just stay in their beautiful utopias.

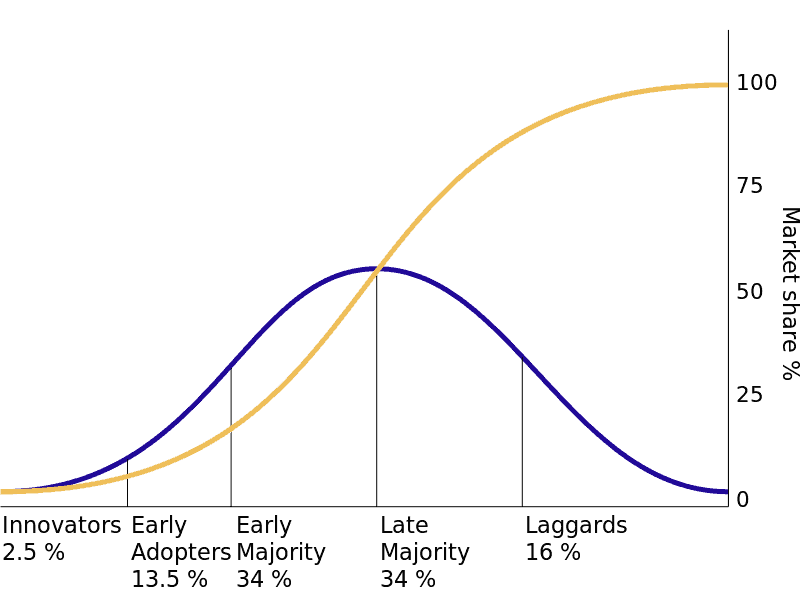

The theory of diffusion of innovation

Problems related to scalability and performance that have been dividing the community and fuelling doubt as to the effectiveness of these systems in high demand environments are being addressed, but we are still at an early stage of the technology life cycle. According to the theory of diffusion of innovations experts agree that we are currently at the end of the “early adoption” phase and foresee a five to seven year period for maturity to be reached.

Are there any real world projects?

Yes, we can currently find interesting examples of projects that are already using the technology. For example:

- How the UN sent food vouchers to refugees through Ethereum.

- The government of Dubai announced the creation of the first state cryptocurrency through which taxes, fees, etc. can be paid.

- Moscow will store the property registry in a Blockchain.

And in Spain a few months ago several companies launched Alastria , the first semi-public Spanish blockchain network that aims to create a collaborative environment to launch the projects and services developed on it. Ferrovial has recently joined Alastria, demonstrating once again that it is at the forefront of innovation and digital transformation.

So all companies, whether large or small, should be attentive to future business opportunities that Blockchain can offer us. This technology’s experts want to clear up all doubts and gain the confidence of the masses. For now, we can find some cases, and even the U.S. television series Big Bang Theory – for geek fans – whose episode on 30 November is all about Bitcoin.

There are no comments yet